The Ultimate Guide to Creating a Family Budget

This post may contain affiliate links. If you buy through the link, I may earn a commission. Learn More.

When it comes to taking care of your family in the present, and for the future, very few things are as important or as far reaching as your family finances.

This article is going to help guide you and your family in creating a family budget.

*Disclosure: This site contain affiliate links. If you click and make a purchase, I may receive a commission. For more info, please see my disclaimer.

I know.

I know.

I know.

You’re already mumbling to yourself about how hard it is to take care of your family and make sure they have everything they need.

This is just one more thing somebody is trying to add.

I would argue this is one of the things that should already be in your to-do list when it comes to taking care of your family.

If you’re still rolling your eyes and two seconds away from clicking the back button and moving on to something else, I urge you not to and that you’re not alone.

Unfortunately, many Americans don’t pay attention to their household family finances as they should.

While some of it is a lack of interest, many families (approximately two-thirds of families) are not knowledgeable when it comes to money topics (source).

For those families, talking about creating a budget, having an emergency fund, or saving for retirement might as well be speaking another language.

It’s a shame when you see some of the statistics on personal finance:

➤ Almost half of American households would not be able to cover a $400 emergency without having to sell something they own or borrow the money from somewhere (source).

Think about what this means for a second.

This implies that about half of families don’t have $400 in their bank account to cover an emergency.

Before you start thinking this number only includes low-income earners, it doesn’t.

This percentage also includes high-income earners.

➤ Only about a third of American families pay attention to their household budgets (source).

➤ Half…yes half of all Americans are living paycheck to paycheck, and no that’s not just families who are low-income earners (source).

(If you don’t know what living paycheck to paycheck means. Keep reading I go into that later.)

Some of those statistics sound alarming just looking at them in a vacuum.

But when you look at them through the effects it has on the family it can look worse.

What is a Family Budget

A family budget is an estimate of how much income your family is going to have and the total expenses the family is going to incur.

Most budgets are typically done a month at a time.

Though having one done for a time frame shorter or longer than a month could also happen.

How Poor Budgeting Effects Your Family

We’re going to go into how not managing your household budget can affect your family.

The first thing you’ll notice is the effects can be far-reaching. For starters…

1. You’ll Get into A lot of Debt

Getting into debt is one of the first things to happen when a household budget is not handled appropriately.

There’s a lot of reasons for this.

Many times, debt is used to fund things that parents want so for example, kids’ toys or for family things like tv or furniture.

Other times it’s used when all the money has been spent, but there are still things that need to be paid for such as lights or rent or so on.

Sometimes debt is used to pay for emergency expenses that just happen.

While the discussion between “good” debt and “bad” debt rages on.

One thing is certain unplanned debt is not a good thing.

Which is what happens when families are unaware of how to manage their family budget.

2. Creates a lot of Anxiety

As stated earlier when a budget is not in place, and families are flying by the seat of their pants it creates a lot of debt.

Anxiety tends to follow quickly after that.

Are you in that boat?

Does even thinking about your family’s finances make you anxious?

If so, you’re in the same boat as half of all Americans who are anxious and not very optimistic about their current financial situation (source).

3. Negative Health Effects

Remember when I said not managing your household expenses can cause your family a lot of stress?

Stress itself can cause a lot of negative health issues (sources).

Those issues can range from the typical ulcers and GERD to other potentially more serious health conditions like depression and a weakened immune system.

4. It Affects Your Kids

According to Dartmouth University, a study done by the Journal of Pediatrics found that parents with a lot of debt, specifically debts like credit card, payday loans or other debts of that nature impacted their kids negatively.

They went on to suggest that the reasons could be tied to the increased stress on the parents related to the debt.

Further suggesting the stress level on the parents probably cause them not to be as good of parents as they could have been otherwise.

5. It Puts You at Risk for Living Paycheck to Paycheck

Now I mentioned living paycheck to paycheck earlier.

This is a term I’m sure you’ve heard many times either through “the world is coming to an end financial media” or just around and about.

What I’ve quickly realized is many parents don’t really understand what living paycheck to paycheck means and why it’s important.

There are varying definitions for what living paycheck to paycheck means.

But when you get down to the nitty-gritty, it’s simply not being able to pay your bills if you were to lose a portion or all your next paycheck.

Let me dispel a myth really quick.

“If I made more money, I wouldn’t be living paycheck to paycheck”

Living paycheck to paycheck is not just an income problem.

It can be.

But it’s not the only culprit.

It’s also a money management problem.

Plenty of high income earning families find themselves living paycheck to paycheck if they’re not careful (source).

6. It Affects Your Relationship with Your Partner

Money is a funny thing. It has this weird pull on us and causes us to act in odd ways.

It reigns even truer when it comes to how we act in our marriages.

Money fights and money problems are the number one reason for divorce (sources).

It’s an emotional topic, and if you’re not on the same page with your spouse about your money goals, your dreams and aspirations it can go south really quick.

Without a household budget, you might find it hard to be on the same page with your spouse about what to spend money on.

The Importance of a Family Budget

Alright, so we’ve talked a lot about how not planning for your household income affects your family.

Points we’ve already discussed above:

- Increases debt in the household.

- Creates a lot of anxiety in the home.

- Negative health effects related to the increased stressor on the family.

- How all that stress related to money and debt affects your kids.

- The increased risk of living paycheck to paycheck.

- The impact unmanaged finances could have on your marriage.

Phew…

That’s a lot of points.

What we’re going to do now is look at this from a different angle.

The angle we’re going to look at is what’s the importance of a household budget.

While we’re going to revisit some of the above points quickly through a different lens, we’re also going to look at some new aspects that will be even more beneficial.

If you’re like me, looking at things from a different angle or perspective helps to solidify and build on a point.

Ready?

1. Allows Your Family to Set Financial Goals and to Reach Them

One of the great things about making a family budget is it allows you, your spouse and the rest of your family to set goals together.

Are you trying to save for a big family vacation? Maybe Disneyland?

New flat screen 60” tv?

Whatever it is. A budget makes sure that your actions are aligned with your goals.

2. You Control Your Money

I believe it was Dave Ramsey that said a budget is you telling your money what to do.

So many times, families allow money to control them instead of the other way around.

If you want to decrease your stress and indirectly the stress on your family because of money, you need to be intentional.

3. You Know What’s Actually Going on With Your Money

Do you know roughly how much you bring home a month?

What about how much you’re spending a month?

If you don’t have an idea of both of those then you’re putting your family’s financial future at risk.

Have you ever run into people whose cable bill or some other bill had doubled for a year, and they weren’t aware of it?

That’s an example of not being aware of what’s going on with your money.

4. You Prepare for an Emergency

Emergencies are just the facts of life.

They’re going to happen.

But it doesn’t mean you need to stand idly by and not do anything.

Nope.

You need to prepare for them like everything else and the best way to do it is with a budget.

The A/C, the transmission in the car, medical expenses, and anything else that’s inconveniently expensive tend to break when you least want them to.

Which is 100% of the time.

5. A Good Budget Can Save Your Marriage

This might be a little bit of an exaggeration.

But not really.

With money fights being the number one reason for divorce a budget can help solve the problem.

With a budget, you and your partner both agree on what you’re going to spend the money on and how much will be spent.

Once you two communicate on what the budget is then the budget gets to have the final say in everything.

Most importantly you two have already talked about where your money should be spent.

So, no surprises.

6. You Find Money You Didn’t Know You Had

This happens often when a family starts a budget.

After being on the budget for a while, they quickly realize oh wow we have “X” amount, but we’re spending so much of it on this activity.

After seeing that they start cutting back on that activity which frees up more money.

7. Prioritize Your Spending

This is one of the nice things about a budget, you can stop spending money on things you don’t give a crap about, so you can start spending money on things you care about.

8. Helps to Cut Down or Eliminate Debt

Remember when I said not having a plan for your family finances could get you into a lot of debt?

Well, the reverse is true when you have a game plan for your money.

You can start seeing ways you can save more money by cutting back on stuff you don’t really want or need and put it towards your debt.

Less debt = less stress

9. Save For Retirement

Nobody wants to think about retirement let alone talk about it.

Unfortunately, retirement is in everybody’s future.

10 out of 10 parents are going to retire at some point or another.

As I wrote in Should Parents Save For College or Retirement you don’t want to depend on social security or your kids to help you out during retirement.

You need to have your own retirement nest egg.

10. Become More Generous

One of the things that’s great about budgeting and having your finances under control is it gives you an opportunity to be generous.

Many families would like to be generous, but they don’t have the money for it.

Your family could.

11. Change Your Family Tree

This is one of the slogans Dave Ramsey used a lot; change your family tree by building wealth.

You build wealth by getting control of your family finances and budget.

Telling your money what to do and making decisions that will set you up in the long run.

How to Set Up a Household Budget?

When it comes to creating a household budget, many families will not know where to begin.

There’s a lot of different ways you could do your family budget.

We’re going to show you one of our favorite ways to start a simple budget.

Part 1: Figure Out Your Family Monthly Income

With step 1 you’re going to add up all the income that comes into your family household.

So, this would be income from both parent’s checks from work.

If any income comes into the family from any outside investments or child support, make sure to include that also.

Part 2: Figure Out Your Household Monthly Expenses

The next step is to figure out the major categories for all the expenses in the household.

When just starting a budget, you can be as general as you want.

As you get more proficient at budgeting, you’ll want to make it more detailed.

So, for example, you could have mortgage or rent payments, food bill, utilities, student loans and so forth.

Part 3: Line-up Your Expenses

For step 3 you’ll want to list out your expenses based on the most important expenses to the least important.

For example, the starting point should pretty much always be food, water, and shelter.

In other words: your expenses for food, your utility bill and what you pay for rent or mortgage.

Part 4: Estimate Your Expenses for Each Category

With your expenses in order you’re going to go through and estimate how much you spend in each category.

For the payments that are fixed:

Fixed Payments:

(Fixed payments are payments that don’t really change from month to month.

An excellent example of this would be your rent or mortgage.

From month to month you can expect your rent or mortgage won’t really change.

Another great example would be insurance payments and for the most part your cable bill.)

It’ll probably be easier to make estimates compared to your expenses that are variable:

Variable Payments

(Variable payments are payments that could vary from month to month. Utilities like electric bill are prime examples of a variable bill.).

So basically, start from the top with the important bills and work your way down to the non-essential bills.

I know this is going to sound difficult to many of you especially if you’re not used to making a budget.

Don’t give up.

I promise it gets a lot easier with time.

Part 5: Figure Out Your Total Income and Total Expenses

Now it’s time to add up all the numbers on your income side and then add up all the numbers on your expenses side.

Depending on how the numbers are looking like will determine the next parts.

Part 6: Base Your Goals on Your Budget

Next up is setting up what you want to get out of your budget.

This will vary based on what your goal and your family goals are. It’ll also vary based on how your budget looks

We’re going to look at two scenarios. The first is what your budget will look like if your income is greater than your expenses.

The other scenario is looking at what your budget will look like if your income is less than your expenses.

Income is higher than your expenses.

Part 6-1: After doing part 5 and if your income is greater than your expenses, then pat yourself on the back.

Whether intentional or not it’s the direction you want to be heading in

The next thing is to…

Part 6-II: Look over your income and expense column and see where the points of improvement are.

For example:

Are you saving for retirement?

If so.

How much?

Are you overspending in a different category?

Maybe a cable bill that’s too high?

Income is less than your expenses.

If you have the reverse problem, then your income is less than your expenses.

If this is your current situation go back through your income and expenses.

There are several questions you can ask yourself. Questions such as:

“How can I make more money?”

“Is there money coming in I didn’t take into account?”

“How can I cut down my expenses?”

The income part is fairly self-explanatory.

Did you include all sources of income?

If you did.

Then the next question could be how can I make more money?

Maybe taking a part-time job even if it’s temporary.

Another option could be to sell something.

If you have a lot of expenses in the form of loan payments that you’re paying, selling something especially if it’s something of high value could give you the lump sum you need to change your entire budget.

As for the expenses.

Check and see where your money is going and what you can start cutting back to make the math work.

If you organized your expenses as we suggested in part 3 it’s a lot easier.

So, based on part 3 your expenses should already be in order from the most important

(so expenses you would have a harder time adjusting like your rent or mortgage)

to the least important

(your family expenses that are not essential and more easily changed so for example cable).

Based on that start from the bottom and work your way up.

I know this is not going to be fun.

Honestly, I hated this part whenever I had to do this.

But think of it this way, it’s only temporary. You’re making sacrifices in the short run to win in the long run.

Part 7: Start Paying Attention to Your Expenses.

As you’re going through each month (at least when you first start making a budget), you want to make sure you’re keeping tabs on your expenses.

As you make a budget for the month you want to start keeping tabs on it to see how well you’re following it each month.

As you track your expenses, you’ll be able to see where your money is going.

Even if you never make a monthly budget. You should at least know where your money is going.

Resources We Recommend to Help Make Tracking Your Budget Easier

To help you track your family finances, Mint.com. is a great resource you can use.

Their FREE app and website is how we track our family finances and make our household budget.

One of the reasons we like is it’s simple and connects to your banks, so everything is automated, and best of all it’s FREE (which is what I care about).

The app does what it’s supposed to do for a no cost to you.

I will mention there is one downside to it.

You’re going to see a fair bit of advertisement on the site for credit cards and other services you probably don’t really need.

They have to make their money to I suppose. They never spam my email and the ads on the site aren’t really intrusive.

Part 8: Keep Re-Evaluating Your Budget

As you budget and track your expenses, you want to make sure you’re evaluating on how you can improve your finances.

And of course, lastly…

Part 9: Rinse and Repeat

With budgeting practice makes perfect.

Tips for Creating a Family Budget

1. Ask Yourself Where You Want Your Family to be Financially

This is a critical question to ask yourself and to have your spouse ask themselves also.

If you have older kids that could be impacted by the family starting a budget, you should try to get them involved too.

Starting a budget can be hard especially if you’re trying correct spending that’s been uncontrolled for a long time.

It’s going to be hard to get yourself and the rest of the family on board.

One way to help is to understand “why” you’re doing this.

You and your family don’t have to like budgeting (I know we don’t), but you need to get them to fixate on the why.

2. Get the Whole Family on Board

This goes along with the previous tip, but we felt it needed to be highlighted.

You’re going to have a hard time getting this done without the buy-in of your kids (if they’re older), and it’s pretty much a no go if your spouse isn’t on board either.

Figure out what you need to do to get them on board.

One of the best ways to do this is by figuring out what’s important to them and seeing if there’s a compromise that can be made.

3. Be Patient

You need to make sure you’re being patient with yourself and with your spouse. Getting into the groove of a budget can take some time, but you’ll eventually get there.

4. Set a Realistic Budget

Budgets are hard especially if you’ve never done one before. Every family is different, so it’s hard to give a hard and fast rule for a budget.

You do need to make sure that the goals your setting for your budget are reasonable.

Setting unreasonable expectations in your budget is a sure-fire way to make sure it fails.

It’s important to note that you’re not going to get the numbers right the first time. Keep working on it to figure out what works for your family.

5. Look for Ways to Save Money

Make sure you’re looking for ways you can save money.

Whether it’s by paying attention to sales or buying in bulk or something of that nature.

Many families have also found success using apps like Ebates or Ibotta to help save money or earn extra money on their purchases.

Frequently Asked Question on Family Budgets

Does it Mean I Can’t Buy What I Want?

When you first start you or your spouse (probably both of you) are going to look at budgeting as restricting.

Try to change your mindset as a budget giving you freedom.

Yes, freedom and permission to spend.

You see when you’ve set up your budget ahead of time, and you and your spouse agree with the budget than you’re free to spend (within the limits of the budget).

Are you wanting a nice outfit?

Or the new phone that just came out?

During your budget meeting talk about it and discuss it and if it makes it into the budget.

Spend away!

What if I’m Not Good with Math? Or I don’t like it?

Don’t let mean ole math discourage you from doing a budget.

It’s just a funky looking “t” (+), and a “1” that fell down (-).

But seriously.

Nowadays you don’t need to like math to budget.

There are so many resources like online programs out there that make this process easy.

Services like Mint and YNAB allow you to set up and have your banking transactions pool over to their system and your budget and keep track of your expenses from their dashboards.

Set it up, and much of it will become automated.

How Much Money Should We Spend on Each Category?

Many families are going to want a hard and fast rule when it comes to this. While there are some general guidelines many times the answer is going to be…it depends.

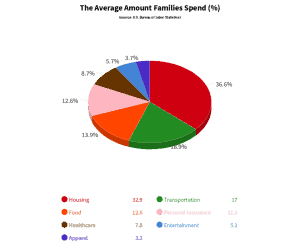

According to the Bureau of Labor Statistics, this is the percentage families spent based on different categories based on their income.

- Housing 32.9%

- Transportation (Vehicles, gas, etc.) 17%

- Food 12.5%

- Personal Insurance 11.3%

- Healthcare 7.8%

- Entertainment 5.1%

- Apparel 3.3%

This gives you a general breakdown on average of what other families are doing (source).

As a general rule of thumb, you don’t really want to spend more than 25-30% of your income on housing (source).

But for a many, it’s going to vary.

If you have a bigger family, you could be spending more money on food.

Many times, you can’t really control health conditions.

If you have a chronic condition, your healthcare expenses could be higher.

The same way if your family is very healthy your healthcare costs could be exponentially lower.

The main thing you want to ask yourself is what’s important to me and my family and what’s not.

While also making sure you ‘re making room to save at least 15% of your family income for retirement.

Isn’t a Budget Only for Low-Income Families?

The short and simple answer is no.

A budget benefits every family.

Living paycheck to paycheck or having debt that spirals out of control is not something that’s reserved for just low-income families but for families who are not diligent about their household finances.

Conclusion

Budgeting is neither fun or sexy. But it’s essential to making sure your family is taken care of today and tomorrow.

Budgeting is a way for you to keep tabs on your finances.

When you do, there are tons of benefits ranging from personal health benefits to relationship health.

Our nine simple steps for budgeting is a tool to get you started on your way to budgeting for a better tomorrow.

Just remember with budgeting practice makes perfect and you’re not going to get it right the first time.

Other Posts:

Are you expecting a baby? Checkout: 13 Essential Pre-Baby Financial Planning Advice

What’s been your success with budgeting?

Thank you for taking the time to read this article.

We hope you found it helpful.

Please take a second to share this article, so we can help others.

Resources Mentioned in this Article

Budgeting

Saving money / Earning Money

This is really a detailed guide on setting up family budget. I really learn from it and agree with you especially on your point on “prioritizing your spending”. This is one of the key principles that make the whole thing about family budget work.

As a freelance business and finance writer, I really understood how prioritizing one’s expenses can help in a lot of ways. This I got to confirm again when I was setting up my first freelance writer’s website at RasheedWrites.com. I wouldn’t have made it if not for applying this same principle.

Thanks for the piece.

Hey Rasheed, glad you found the article helpful.